In this post, I’ll be sharing important money lessons I wished someone told me about growing up that I’ve had to learn and figure out on my own (thanks Google and life experience lol). I’m still learning and will continue to learn!

Side note: is it just me or when you turn 25, it feels like a whole new perspective on how you view the world around you is awakened?

If you don’t read or finish this post or don’t even remember what you read, please remember the biggest money lesson of all time. When you’re in your 20s, your biggest wealth-building machine is TIME! Start early by making healthy financial decisions such as living below your means and investing the difference consistently, while still enjoying your life.

Here are the 15 money lessons I’ve learned as a 25-year-old:

Lesson 1# – Invest in yourself

Investing in yourself is a critical money lesson that can help you build wealth over the long term. While it may not necessarily involve putting money directly into an investment account, investing in yourself can lead to better career opportunities, higher income potential, and more financial stability.

Pursuing continuing education, attending career development workshops or seminars, prioritizing your physical and mental health, pursuing hobbies and interests, and learning about personal finance and investing are all ways to invest in yourself.

Lesson #2 – Track spending

If you’re in your 20s and looking to get a handle on your finances, then creating a spending plan should be at the top of your list. A spending plan, also known as a budget, is a roadmap for your money. It helps you track your income and expenses, prioritize your spending, and make intentional decisions about your money. And the best part? It doesn’t have to be complicated or boring!

You can use tools to help you stay on track: YNAB.

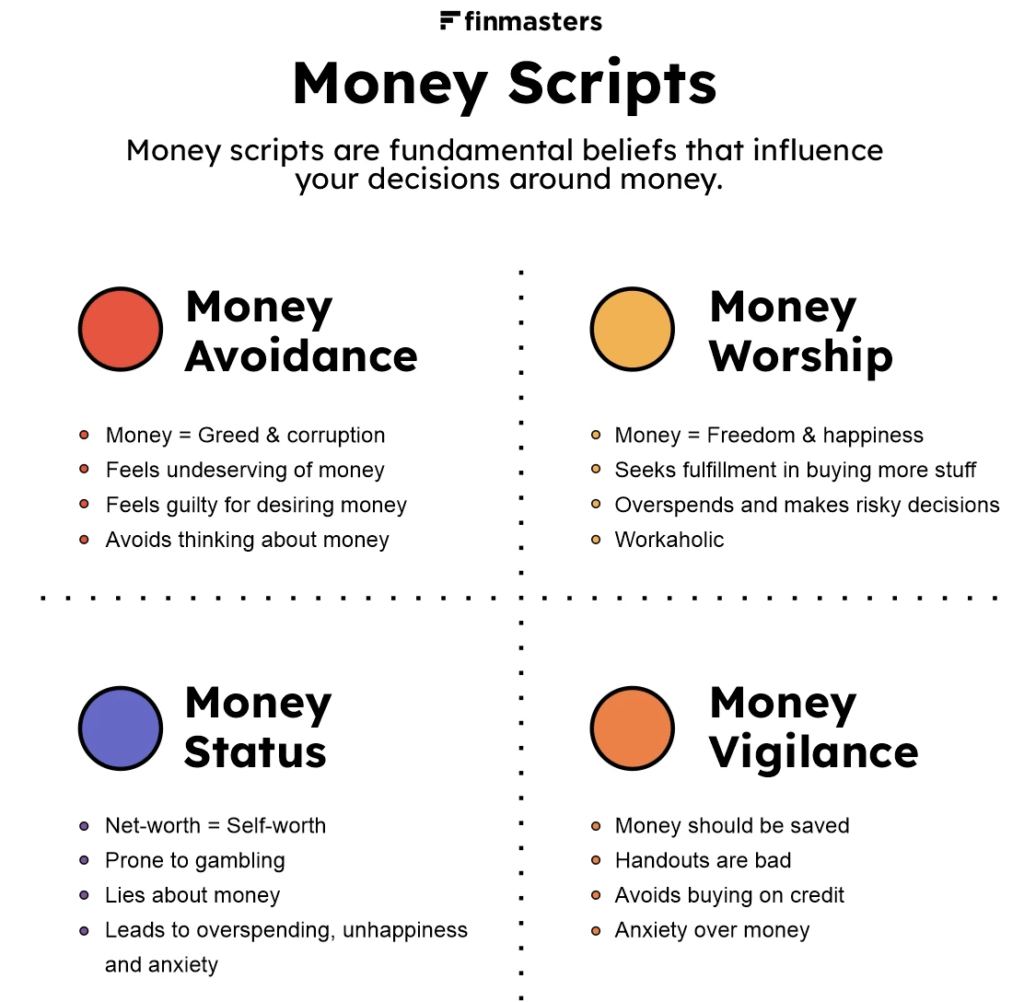

Lesson #3 – Know your money scripts

Think about your childhood – did you have money conversations with your family? How was the family’s financial situation? Believe it or not, how you grew up with money affects your relationship with money as an adult.

Have you heard of money scripts? They are your unconscious money beliefs about money picked up while growing up. The term was coined by Brad Klontz in a study about money beliefs and financial behaviors. The study identified four types of money scripts, known as the Klontz-Money Script Inventory:

Knowing your money scripts can help you unlearn some money beliefs you’ve had that are impacting your financial well-being.

Lesson #4 -Spend less than you make

One of the most important money lessons I’ve learned as a 25-year-old is to spend less than I make. It may sound simple, but it’s a lesson that many people struggle to follow, especially in their 20s when the temptation to spend on experiences and material possessions is high.

We live in a consumerism society where we’re constantly bombarded with ads and content showing “flash sales,” “buy now, pay later,” “luxury lifestyle,” and so much more. We’re bound to fall for the trap of living a lifestyle we cannot afford.

If you find yourself living paycheck-to-paycheck, think about what you could do to improve your situation. I know it’s not easy and everyone’s situation is different, but whatever you can do within your power to turn the situation around, do it!

>> Related Content: How To Properly Manage Your Money

Lesson #5 – Build an emergency fund

I can’t stress this important money lesson enough, but emergency funds are crucial! The funds are used for exactly what they’re made for – emergencies. The rule of thumb is to save 3-6 months’ worth of your expenses in a high-yield savings account.

>> Read more on Why You Need an Emergency Fund.

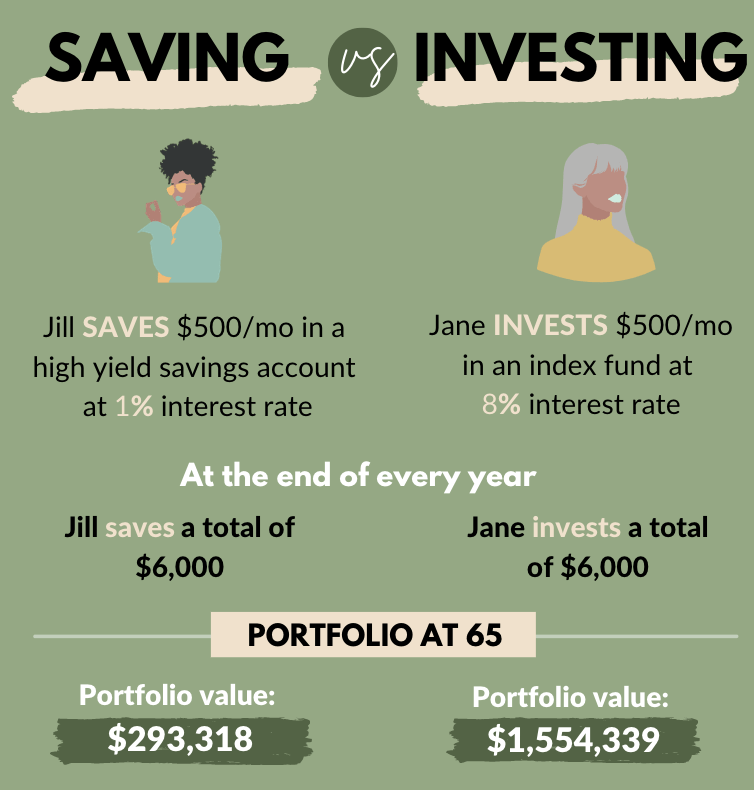

Lesson #6 – Start saving and investing now

“You can save your way to wealth,” said no one ever! It’s practically impossible, which is why you must INVEST. There’s a big distinction between saving and investing, but both are needed to build wealth. The earlier to start, the better you position yourself financially in the years to come. Aim to put away at least 20% of your income into appreciating assets like the stock market or real estate.

Savings are more for short-term goals while investing allows you to play the long game.

If you’re new to investing, you will find these posts super helpful for your investing journey:

- How to Start Investing in the Stock Market as A Beginner

- 5 Reasons Why You Should Start Investing Early

- 10 Things You Need To Do Before You Start Investing

- 5 Best Accounts You Must Have to Build Wealth

If you want to reach financial independence, the principles are straightforward, but not easy:

- Spend less than you make

- Take the difference and invest it

- If there’s no money left –> Reduce your spending OR/AND Make more money

- Repeat until you reach financial independence

Lesson #7 – Read books

The only books I read in college were my textbooks lol. It wasn’t until I graduated college that I picked up reading books on personal finance, business, and self-development. Let me tell you; my perspective on certain aspects of my life has changed for the better. Do not underestimate the power of reading. It provides fresh and exciting ideas you’ve never thought of and amazing money lessons to learn from.

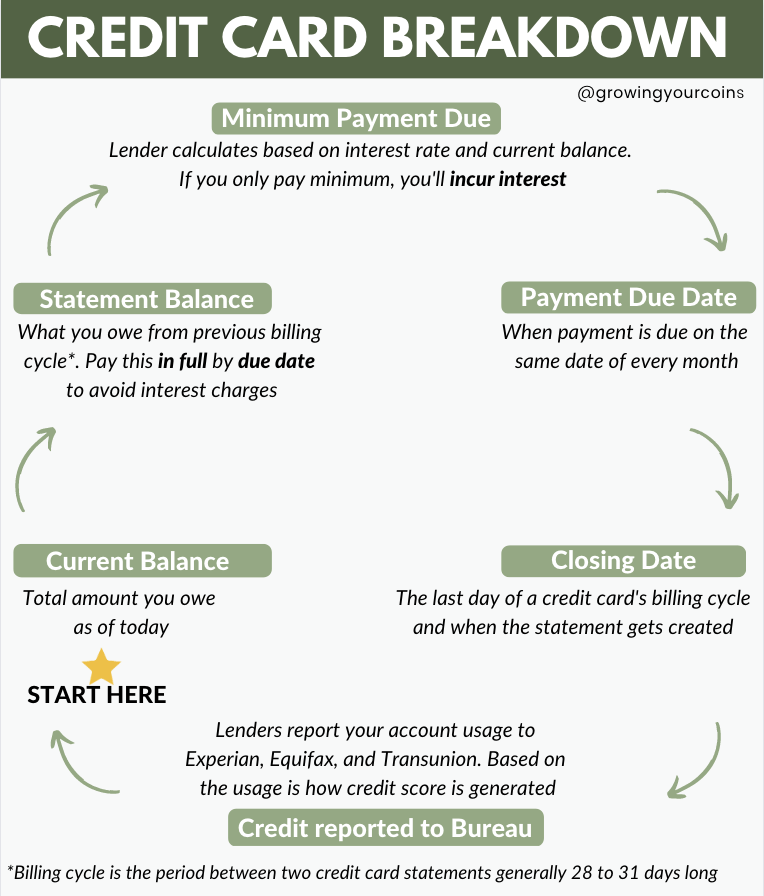

Lesson #8 – Avoid credit card debt

Please avoid this like a plague!! DO NOT carry a statement balance on your credit cards. It’s the worst consumer debt anyone should have due to the ridiculously high interest rates (over 25% APR), yuck! Don’t get me wrong, I’m not saying credit cards are evil, as they have great perks. However, if not used wisely, it’ll work against you.

Don’t let that shiny plastic or metal (like the Chase Sapphire Preferred card) take over your life if you have unhealthy spending habits. On the flip side, if you manage your money well, you get rewards such as points/miles, cash back, cell phone protection, trip insurance, etc.

If you’re a newbie to credit cards, see the graphic breakdown below:

The biggest money lesson here is to pay off your statement balance by the due date to avoid accruing interest.

Related Content:

- Credit card recommendations (Discover and Chase)

- How To Pay Off Debt In 2022: 7 Practical Tips

- How to Choose the Best Credit Card for You

- 5 Best Credit Cards for Beginners With No Credit

Lesson #9 – Personal finance is personal

Personal finance is personal (period). There are so many finance blogs (like Growing Your Coins), journals, and social media platforms that share amazing money lessons and tips, and some share just bad advice. You need to weed out the content that doesn’t align with your financial situation and focus on the ones you want to emulate.

Lesson #10 – Automate finances

An important money lesson you’ll come to appreciate is automating your finances. Automation allows your finances to run on auto-pilot, takes away your stress, and reduces anxieties.

Let’s see an example of how automation improves your financial life: Your goal is to save $5k by the end of the year. How do you go about accomplishing this without slacking or giving up too quickly?

- Open a high-yield savings account (I use Marcus by Goldman Sachs) separate from where your checking account is

- Connect your checking account to your savings account

- Set a recurring transfer of $416.67 ($5k/12 months) every 24th of the month or whatever date works best for you

- You’re done

You can apply this to your bills, credit card payments, loan payments, and anything else that needs automation. You should try it!

Lesson #11 – Money is a tool

Money is neither good nor bad by itself but depends on how it is used. An important lesson to know about money is that it’s a tool to help you get what you want. Though money can be emotional, its core use is for you to tell it what to do, not the other way around.

Having control over your money brings peace of mind, financial security, and options to pursue whatever path you want to follow.

How can money be used as a tool?

- Use it to make more money

- Spend on meaningful experiences

- Improve lifestyle

- Fitness training

- Healthy eating

- Traveling

Lesson #12 – Increase skills + Income

Earning more income has many advantages and disadvantages too depending on how it’s utilized.

Pros: It opens more doors to do the things you want to do. If you have debt, you can pay it down faster, if you want to save and invest, you can put more down, if you want to travel, you can do so comfortably.

Cons: You could experience lifestyle inflation or take bigger uncalculated risks.

Now, making more money isn’t always the answer to every problem if you don’t have good money habits. If you have a spending problem, more money won’t fix it because you can’t handle what you already have. Going back to money lesson #10, use your money as a tool.

Increasing your skills should potentially correlate with increasing your income potential. If you’re able to learn specialized skills such as cybersecurity, software engineering, or anything really that there’s demand for, you make yourself a valuable contributor in the eyes of an employer.

There are so many online resources available: LinkedIn Learning, Youtube, Google Certification, Harvard Free Classes, and many more.

Lesson #13 – Build good credit

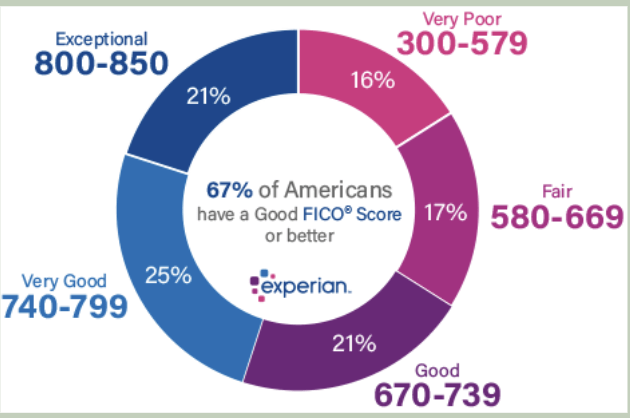

When “adulting” begins with getting your first car or apartment, you’ll realize another money lesson is the importance of having a good credit score and credit profile. A credit score shows your creditworthiness to borrow and repay money.

When you have good credit, you get access to lower interest rates on car loans, personal loans, and other types of credit. This will save you money in the long term because you demonstrate you’re good with money.

How to build good credit:

- Start with secured cards (Discover It is the best one to go with)

- ALWAYS pay off the statement balance in full by the due date

- Do not go above 30% of your credit usage

- Know your credit score and profile (Download Experian for FREE)

Related Content:

Lesson #14 – Experience new things

There’s a balance to everything in life! This is your time to explore and experience new things and go out of your comfort zone. I also know this is the time you’re just starting to earn more money, which doesn’t leave you with many options to do all the things you would like to do.

Being in my 20s, I’ve come to realize it’s important to spend money on things that bring value into my life, not just physical items. It’s about being intentional with what I spend money on. Sure, a new dress will make me happy, but the excitement wears off after a while and is replaced by something else. I would rather spend it on experiences that will last longer, but that’s just me.

Ultimately, you decide what works best for you. The world is your oyster!

Lesson #15 – Track your net worth

Tracking my net worth was a serious money lesson for me. I didn’t track my net worth until I got my first big corporate job after college. I’ve come to realize that it’s very important to track it because it helps you understand the “temperature” of your financial journey.

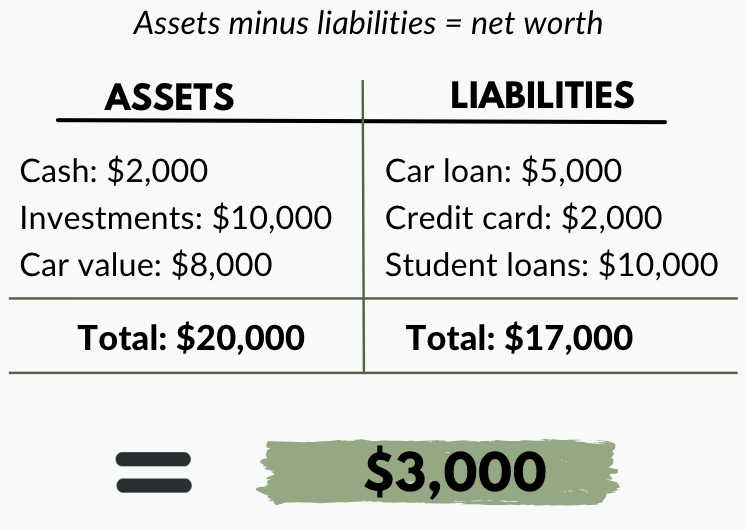

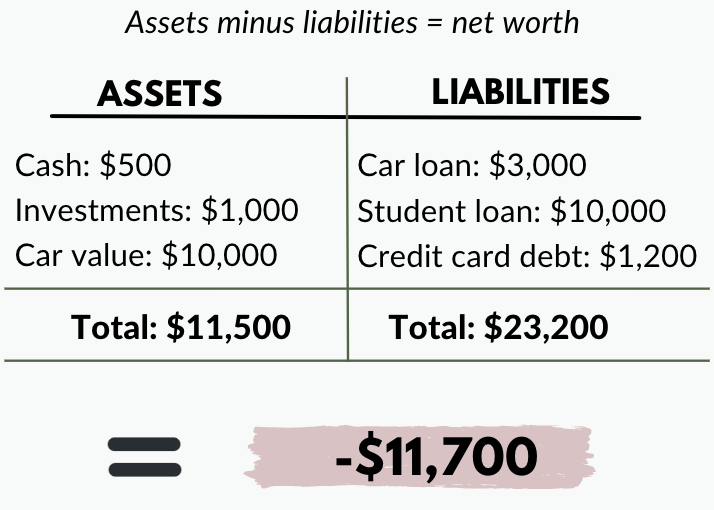

Net worth Calculation: Assets MINUS Liabilities (debt)

Assets – what you OWN. e.g cash, investments, home equity, car

Liabilities – what you OWE e.g credit card debt, car loan, mortgage

Let’s look at a positive net worth example:

Let’s look at a negative net worth example:

Ideally, you want to have a positive net worth number, because it shows you’re headed towards a good place in your financial journey. You want to update it monthly if you’re tracking it manually.

You can track your net worth yourself. You can use a good old Excel spreadsheet or online apps/software. I recommend Monarch Money or Empower (formerly Personal Capital).

If you read to the end, thank you 🙂

Let me know in the comment section if any of these money lessons resonated with you or want to add more lessons!