Investing in the stock market as a beginner is hella scary… I know! This post should help remove that investing fear and overcome it by getting fully armed with resources on how to start investing in the stock market as a beginner.

When I was in college, I always said “oh I want to invest in stocks, bonds, mutual funds, and blah blah blah.” It took me four years to finally start investing in the stock market.

Related Content: The Best 13 Financial Tips for College Graduates

What’s my point exactly? I wish I had taken the time to really research and just started sooner with as little money as possible. I held back for so long because I was very scared of losing money meanwhile what I was actually losing was time, capital gains, and compound interest.

Related Content:

- 10 Things You Need To Do Before You Start Investing

- 5 Reasons Why You Should Start Investing Early

- 5 Best Accounts You Must Have to Build Wealth

Trust me I get it! Investing can be scary and confusing, but it really isn’t if you’re in it for the long run, keyword long run. There are so many articles and resources out there that it can be overwhelming and even full of false information or scam.

Disclaimer: Before we dive into anything, I am not a financial advisor. I am just giving my knowledge based on legit research and experience. Please do your own research and invest at your own risk!

Hopefully, this breakdown I’m about to explain will help answer your questions, clear your fears, and boost your confidence to start living like the 1%.

Remember the golden rule about investing

Warren Buffet said that there are really just two rules of investing:

- Rule 1: Don’t lose money

- Rule 2: Don’t forget rule number one

Investing is about certainty and not speculation or trying to beat the market because you will never be able to.

How to start investing in the stock market as a beginner

Make sure you read this post: 10 Things You Need To Do Before You Start Investing.

1. Invest in Yourself

Your greatest asset is you, facts! No one knows you better than yourself; no one will care more about you than yourself, so why not feed yourself with the right tools and information?

When I say invest in yourself, I mean: read financial news websites, read personal finance books, listen to podcasts, and watch educational youtube videos. Don’t just read, practice, and do it.

Your goals and mindset need to align to get the right results you’re looking for. Create an action plan, fail fast, learn from your mistakes, and move on.

Here are some great resources to help you learn how to invest or become a better investor:

- Visit Investopedia for holy grail investment learning (you will soon notice that I use them a lot as an external resource for terms definition). Learn financial terms using their dictionary

- If you’re a visual learner and want to watch videos, Napkin Finance has 30-second to 1-minute videos on finance topics

- Check your local library, but you can easily find resources online too

- Finance websites: yahoo finance, nerdwallet, and FINVIZ

2. Define Your Goals

Before you start investing in the stock market, you absolutely need to identify your goals. Your goals will guide you on what type of accounts to open, what to invest in, and how much to put away.

Here’s a starter template:

- Why do you want to invest?

- What are your investing goals? Save for retirement, be financially independent, save for travel?

- What is your time horizon? Short-term or long-term

- What is your risk tolerance? if stock A drops 50%, how much loss can you take? Do you sell right away or keep holding?

- How much can you invest consistently?

If you can answer these questions, you’re off to a great start!

3. What Account to Use

Your next challenge is to figure out what type of investment account to open.

- If you want to save for retirement, I have a post that explains the types of retirement accounts

- If you want to save for a goal, travel, or just build your money, this post explains a taxable brokerage account

- If you want to save for your kids, check out the 5 best investment accounts for kids

4. How Much is Needed to Start Investing in the Stock Market?

I used to think you needed a lot of money, like thousands of dollars to invest in the stock market. Guess what? Yep… you guessed it! It’s so not true.

Usually, there are two ways: Dollar Cost Averaging (DCA) or lump-sum. With DCA, you invest a certain amount at certain intervals (monthly or quarterly), while with lump-sum, you invest all at once. Both have their advantages and disadvantages. Ultimately, it depends on your financial situation and preference. I recommend DCA for a beginner to get your feet wet.

You can invest with as little as $5 and work your way up. This is known as fractional shares – when you own less than one whole share of a company. For example, let’s say 1 share of XYZ company is $50, you can buy XYZ with $25 and own 0.5 shares. When you add another $25, then you own 1 share to equal $50.

Don’t wait to make big bucks before you start investing in stocks. Compound interest is your best friend. It is so amazing, Albert Einstein said “it is the eighth wonder of the world.” The rest of the quote reads, “He who understands it, earns it. He who doesn’t, pays it.” Did you know that?! Seriously start investing now; this is your sign!

Related Content:

- 5 Reasons Why You Should Start Investing Early

- 5 best investment accounts for kids

- 5 Best Accounts You Must Have to Build Wealth

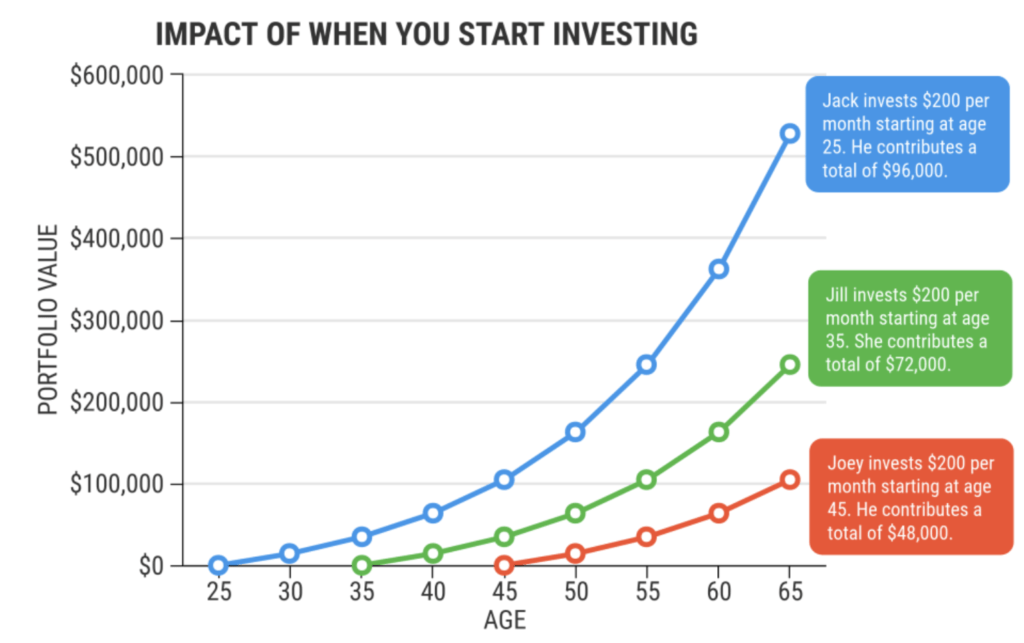

As you can see, Jack invests $200 at age 25. By age 65 he would have accumulated over $500,000. Jill invests the same amount but starts at age 35, and by 65, her portfolio would be around $245,000. Joey starts at 45 and would only have $100,000. Bottom line: the earlier you start, the better.

5. Where to Open an Account

Let’s say you chose to open a Roth IRA account, you need to find a platform where to open that account. This is where a brokerage firm or platform comes in.

A brokerage firm is where you house your investment account to be able to invest in the stock market. There are many of them out there: Fidelity, Vanguard, Charles Schwab, and many more.

For DIY investing strategy:

- Robinhood: Great for beginners, with no fees!

- Charles Schwab is also highly recommended

- TD Ameritrade: Great for beginners with no fees

- Fidelity

For Robo-Advisor or manager-managed strategy:

- Betterment: Betterment is one of the best robo-advisor accounts and great for hands-off investors

- Charles Schwab: It has both DIY and robo-advisor feature with some fees

- Wealthfront: Algorithmic, rules-based investment strategies with management fees

- M1 Finance: Automate your investments with some fees

6. What to Invest in

This is a common question for many beginners who want to start investing. There are thousands of stocks to invest in, not to mention mutual funds, exchange-traded funds (ETFs), and index funds.

- Stock: When you buy a company’s stock, you own a piece of the company

- ETF: Exchange-Traded Fund is a basket full of many stocks & bonds

- Mutual Fund: Mutual fund is similar to an ETF, except it is bought and sold once a day

Check this article for more detailed explanations of the differences. It shows a Venn diagram for better understanding.

I can’t tell you exactly what to invest since I’m not a financial advisor. However, here are some tips to get you started:

- Research the S&P 500 index (tracks the top 500 companies in the U.S) and choose an index fund or ETF that matches it

- Look into the Total Stock Market index (it has over 3k companies) and choose an index fund or ETF that matches it

- If you want to diversify your portfolio, look at Real estate index funds/ETFs

Make sure you actually press “BUY” in your investment account. If you transfer money and don’t press “Buy”, you haven’t invested. This is a really important thing to note as a beginner!

If stuck, Warren Buffet advises buying what you know. What are some products you use every day and stand by? When you buy a stock, you essentially buy a piece (known as a share) of the company.

7. Be Aware of Fees

Be aware of unnecessary and ridiculous fees and transaction costs when choosing your investments. This is one of the most common investing mistakes that people make.

Most brokerage firms offer free or very minimal fees to invest with their apps or accounts. Do your research and ask questions!

8. Regular Check Up on Investments

It is good to check up on your investments quarterly or whatever works for you. Think about these questions: Have your goals changed? Has your situation changed? Make changes accordingly.

I highly recommend using personal capital or Mint to track your net worth, show hidden fees, and analyze your portfolio. It is free and analyzes investment accounts and spending habits.

Tips & Takeaway

1. Start investing early

Some people wait until later in life to start investing. Based on the example we saw above: Jack started investing in stocks at 25 and would have compounded over $500,000 by 65 compared to Jill and Joey!

Imagine if he had started at 20, he would have over $700,000, thanks to the power of compound interest.

Related Content:

2. Have a plan!

Before you start investing, write down your goals. If you’re in deep debt, pay that bad debt off first. Create a budget and keep track of where your money is going and allocate money for investing. Decide which stocks, ETFs, or mutual funds you want to invest in.

Tip: Enable automatic transfer to your brokerage account to keep you on track with your goals. By investing in a fixed amount consistently (monthly), you will yield higher returns. Higher risk = higher returns!

3. Be patient

The stock market goes up and down. Historically, it has gone up over long time frames.

Don’t get too attached or emotional when others are selling – even I fall for this sometimes, but I try to hold out so I don’t make an irrational decision that will cost me a great loss. Remember that you’re in it for the long run!

4. Learn from your mistakes

It’s okay not to get it right the first time. Fail and fail fast so you can learn from your mistakes early on rather than later. Experience is truly the best teacher. I am still learning every day and making myself a better investor 🙂

5. Understand how taxes work

Long-term investments are subject to lower tax rates. This is why at the beginning of the post I said investing is for the long run! Take advantage of tax-advantaged accounts such as 401k, Roth IRA, Traditional IRA, and HSAs if you have access to them.

Related Content:

- 5 Best Accounts You Must Have to Build Wealth

- The Best Credit Cards for Beginners

- How to Choose the Best Credit Card for You

I hope this post made things easier to understand and you now have an idea of how to start investing in the stock market with confidence!

What is stopping you from investing? If you’re already investing, what methods or strategies did you use to get started? Comment below!

Save or Pin for Later!

If you enjoyed this content, please comment, share, pin, and tweet!