Choosing the best credit card for you can be a little daunting, but don’t let it get to you.

Related Content:

Try to answer this question: “Why are you looking for a credit card?” – Is it to build credit, earn rewards, transfer debt, or travel?

Steps to follow to pick the right card

- Purpose of getting a credit card

- Check credit history

- Type of credit card

- Card fees

How to choose the best credit card for you:

1. Purpose of getting a credit card

First and foremost, you need to decide what you’ll use the card for. There’s no single best credit card. It all depends on your goal, spending habit, and credit situation.

2. Check credit score and credit report

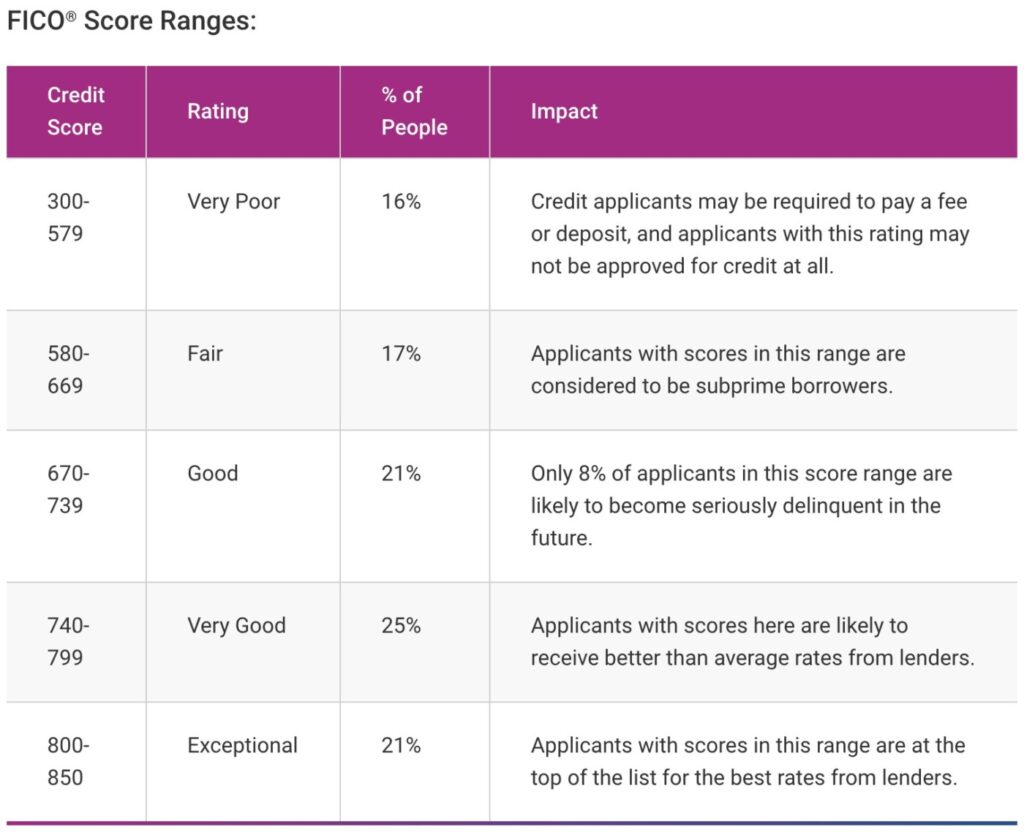

Before applying for any credit card, it helps to know where you stand with your credit history. Creditors use FICO scores to make lending decisions. The greater the score, the better the chances of being approved.

You can use several free tools such as CreditWise, Credit Karma, and Mint to check your credit score if you have a credit history. Fear not if you don’t have a credit history!

>> Check out the best credit cards for beginners with no credit

3. Decide which type of credit card suits your need

Credit cards can be split into three main categories: rewards, credit building, and low or zero interest.

– Do you want to earn rewards? Use cash back, travel, or rewards card

Most credit cards offer great rewards or incentives for their consumers with good to excellent credit. These types of cards offer bonus rewards in certain categories of spending such as groceries, restaurants, or gas.

For example, if you travel a lot, you can apply for a travel credit card that will give you perks such as points for free flights or hotel booking, free wifi and so much more.

To decide which rewards card is the best fit for you, think about your spending habits and situation: Do you spend a lot in a certain category? Do you want to use multiple cards for different purchases and specific rewards?

You decide.

– Do you want to build or rebuild credit? Use student or secured card

If you’re just starting to build your credit, you can apply for a student credit card and get approved almost immediately.

- Secured cards are designed to help people with no credit. You pay a cash security deposit and you get a card with a credit limit that’s the same as your deposit.

- Unsecured cards are designed for people with poor credit and don’t require you to put down a security deposit. However, these cards carry higher fees due to consumer risk.

- Student cards can be either secured or unsecured, but only available to students.

– Do you want to pay off debt? Use balance transfer, low interest, or 0% APR card

Term: Annual Percentage Rate (APR) is the interest rate you’ll pay if you carry a balance on your card.

Things happen that cause situations to change and if you’re trying to rebuild your credit because you’ve stacked up a lot of debt on all your credit cards, you’re not alone!

The first step is to consolidate the debt (transfer debt from one or more credit cards) and get a transfer balance credit card with no APR for the first several months. This will help eliminate interest from growing and give you the proper time to pay down the principal balance.

4. Review card fees

Don’t disregard a card just because it has an annual fee. You need to compare and do the math if it makes sense for you. Do the rewards and perks outweigh the annual fee? If yes, then why not – you might make the annual fee back through the rewards.

Compare the sign-up bonus, interest rate (APR), perks, and bonus rewards to make the best determination if you should consider a card with an annual fee.

5. Apply for the best card

At this point, you should have a good idea about what you want. Look for cards that you qualify for based on credit history, type of cards, and how comfortable you are with fees.

Use this link to help find the best credit card.

Next Steps

Make sure to check for credible card ratings/reviews. Ask your friends and families if they use your top choice card.

Be careful not to apply for multiple cards at a time. Apply for your top choice to avoid hard inquiries. Hard inquiries in a short time can cause a dip in your credit score.

Once you apply and get approved, make sure to use the card to its full advantage.

Key terms to know

- APR: Annual Percentage Rate is the interest rate you’ll pay if you carry a balance on your card.

- Debt-to-income ratio (DTI): compares how much you owe to how much you earn. The preferred ratio for most lenders is less than 36%.

- Credit utilization: the ratio of credit card balance to credit card limit. For example, if your credit card limit is $1000 and your balance is $500, then your utilization is 50%, which is very high. The rule of thumb is to keep it less than 30%.

Bad credit card habits to avoid

- Maxing out credit card limit

- Not paying the balance in full at the end of every month

- High credit card utilization (spending more than 30%)

If you’re still feeling overwhelmed and don’t know which cards to apply for, check out my post on the best credit cards for beginners.

Related Content:

- If you want cash back apps when you go grocery shopping or just looking for coupons, check my recommendations page for my referral code

- Best Free Budgeting Apps

- The Best Credit Cards for Beginners

- How to Start Investing in Stocks With No Experience

Please let me know if this was helpful! Do you have other tips or factors you look at to help decide which card to get?

Save or Pin for Later!

If you enjoyed this content, please comment, share, pin, and tweet it!