Are you looking for the best accounts to help you build wealth? Look no further… I’ll be breaking down the different types of accounts and their purposes.

Related Content:

- 30+ lucrative Side Hustle Ideas For 2022

- 10 Things You Need To Do Before You Start Investing

- How To Properly Manage Your Money

1. Checking Account

This is the first place money comes into – paycheck, gift money, tips, etc. It’s pretty much a central hub that connects to other accounts as flows out of it. You use it for everyday expenses and it comes with a debit card and an ATM card. Most banks require a minimum daily balance; if not, there’s a maintenance fee. Isn’t that absurd?!

I have good news! There are amazing banks without a minimum balance or fee. Check out Capital One 360, Schwab Bank, and your local credit unions.

2. Savings Account

The name Savings says it all – SAVINGS. This account helps you put aside money for rainy days (a.k.a) an emergency fund and for planned expenses like a trip or buying new furniture. It’s so important to separate savings from checking to avoid the temptation to touch the money meant strictly for saving.

I highly recommend using a high-yield savings account, NOT your regular savings account that’s earning a peasant interest. I use Marcus by Goldman Sachs. There are other great ones too like Ally and Discover.

Related Content:

- 7 Places Your Money Needs to Go

- The Best 13 Financial Tips for College Graduates

- 30+ lucrative Side Hustle Ideas For 2022

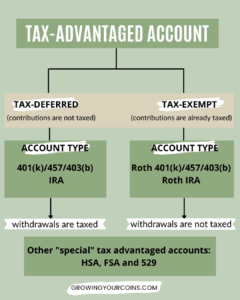

3. Retirement Accounts

Retirement accounts speak for themselves – save money for retirement. When you contribute to this type of account, you typically don’t touch your money or withdraw until the withdrawal age (59.5 years old).

Types of Retirement Accounts

a. Employer-Sponsored Plans

i. 401(k) – It is a tax-advantaged account that allows you to save for retirement. If you’re working a 9-5, there’s a high chance your company has an employer-sponsored plan. If you’re not sure, make sure to ask your HR rep.

Usually, you have to sign up during the first 30 days of starting your new role or during open enrollment. Some companies auto-enroll their employees so make sure you know the process.

Here’s a summary: sign up; choose your desired contribution percentage; pick an investment, and done! The beauty about this is not seeing it before it’s taken out of a paycheck, so it’s like nothing happened.

Your employer might offer something called a “match”. When you contribute a certain amount, they match it up to a certain amount. It could be 1:1 meaning match a dollar for a dollar; that’s extra money for you!! Count me in 🙂

Benefit: Contributions are not taxed and deferred till retirement age. Contributing to a 401(k) lowers your taxable income and your investment grows tax-deferred.

Contribution Limit: You can only contribute a maximum of $23,000 for the year 2024. There’s no minimum.

ii. Roth 401(k) – A Roth 401(k) is just like a traditional 401(k); the only difference is when you pay taxes. With the Roth option, contributions are already taxed and won’t pay taxes again in the future.

Benefit: You paid taxes upfront and your investments grow tax-free!

Limit: You can only contribute a maximum of $23,000 for the year 2024 (filing single)

b. Individual Retirement Accounts (IRAs)

You can open these accounts by yourself without an employer.

i. Traditional IRA – Just like a 401(k), you can contribute pre-tax or after-tax dollars to this account. If you contribute after-tax dollars, you’ll take a tax deduction when it’s time to file your taxes. You need an earned income to qualify to contribute to the account. Earned income counts for salary, wages, and tips.

Contribution Limit: You can only contribute a maximum of $7,000 for the year 2024 (filing single). You can put in an extra $1,000 if over 50.

ii. Roth IRA – Again, Roth means you contribute after-tax dollars and you don’t pay taxes in the future.

Contribution Limit: You can only contribute a maximum of $7,000 for the year 2024 (filing single). You can put in an extra $1,000 if over 50.

Note: You can contribute to both 401(k) and IRA.

You can combine IRA and Roth IRA, however, you can’t go over $7,000 in the combined accounts.

4. Health Savings Account (HSA)

An HSA is described as a triple-tax benefit. Here’s why: you contribute pre-tax dollars, it grows tax-free, and you can spend it tax-free (only on qualified medical expenses). Isn’t that awesome?!!

An HSA is a savings account that allows you to spend money on qualified medical expenses tax-free. Did you catch the keyword: tax-free?? That’s right! To open an HSA, you must have a high-deductible health plan (HDHP). You can either open the account with your employer or you can open it by yourself.

How does it work: if you open with an employer, you contribute pre-tax dollars directly from your paycheck into the account and the money is spent on qualified medical expenses TAX-FREE! If you spend on non-qualified medical expenses, you’ll pay taxes. Qualified medical expenses can be tampons, braces, and many more. Check the HSA Store to determine what’s eligible.

Bonus: Most people don’t know that you can also invest the money in your HSA account to even grow it further versus regular savings. That money will grow exponentially as opposed to keeping it in a savings

Contribution Limit: You can contribute a maximum of $4,150 (individual) for the year 2024.

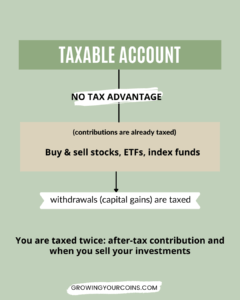

5. Taxable Brokerage Account

This is not a tax-advantaged account like the 401k, IRA, or HSA. The difference is the way it is taxed – you’re taxed twice because after-tax dollars were invested and when you sell you’re taxed again. Okay, let’s not panic as it’s a useful account to have.

It is advisable to contribute to the tax-advantaged accounts first and any money left over you put into a taxable account.

So, why have the account?

- The retirement accounts have contribution limits that you cannot go over; this means if you still have excess cash and want to invest, then put it into a taxable account as there’s no contribution limit

- Another reason to use a taxable account is to access it anytime without penalty or taxes because there’s no withdrawal age limit unlike your IRA (withdrawal age is 59.5 years old)

- You want to save for a down payment on a house or you want to travel within 4-5 years or more. You might want to invest in it to grow it pending your plan to use it

- There are more investment options versus a 401k or an HSA

What are capital gains?

When you sell an asset (stocks, bonds) for more than you paid for it, you get capital gains! As a result, you pay taxes on capital gains, but it depends on how long you hold the asset before selling it. Taxes are based on short-term or long-term capital gains.

In addition, a short-term capital gain is when you sell an asset owned for a year or less while a long-term capital gain is when you sell an asset owned for more than a year. Short-term gains are subject to taxes based on ordinary income while long-term gains are taxed at a more favorable rate. Read more on this here.

In conclusion, try to hold onto your assets for a year and one day before selling to get a favorable tax rate!

That wraps up the best accounts to have to build wealth. Note that each account has a different purpose so use them accordingly.

Related Content:

- How to Start Investing in Stocks With No Experience

- 5 Reasons Why You Should Start Investing Early

- 25 Flexible Ways to Make Money in College

Do you have all the accounts listed here? Am I missing other account types? Comment below!

[…] 5 Best Accounts You Must Have to Build Wealth […]